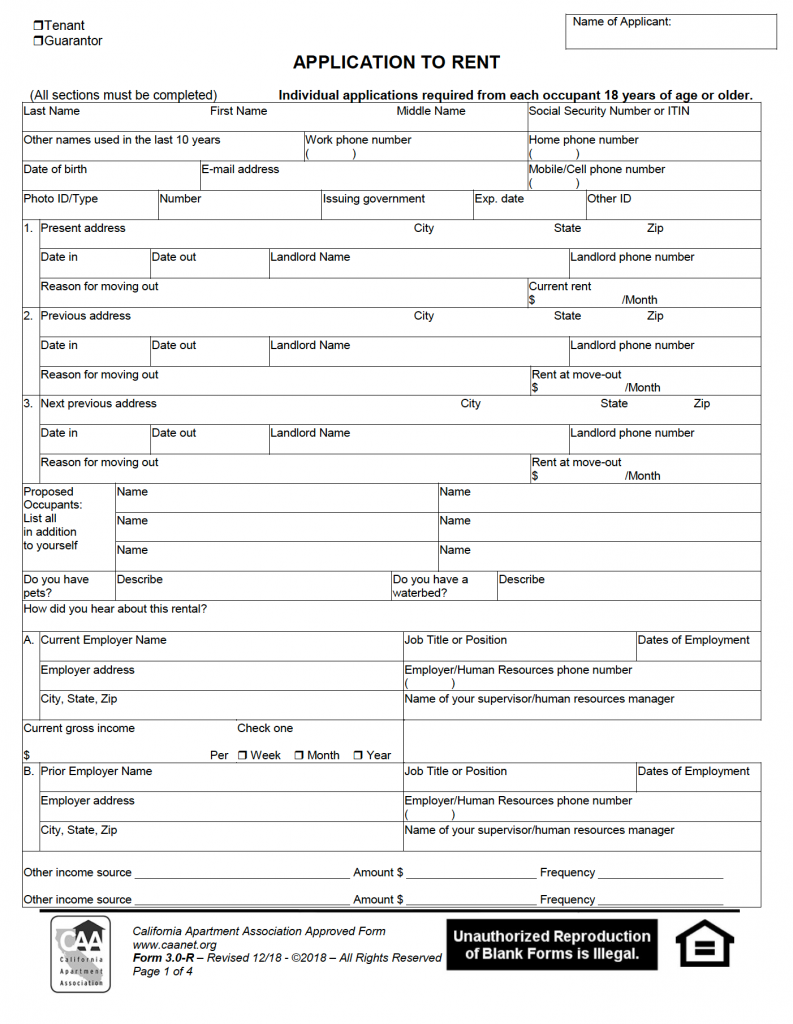

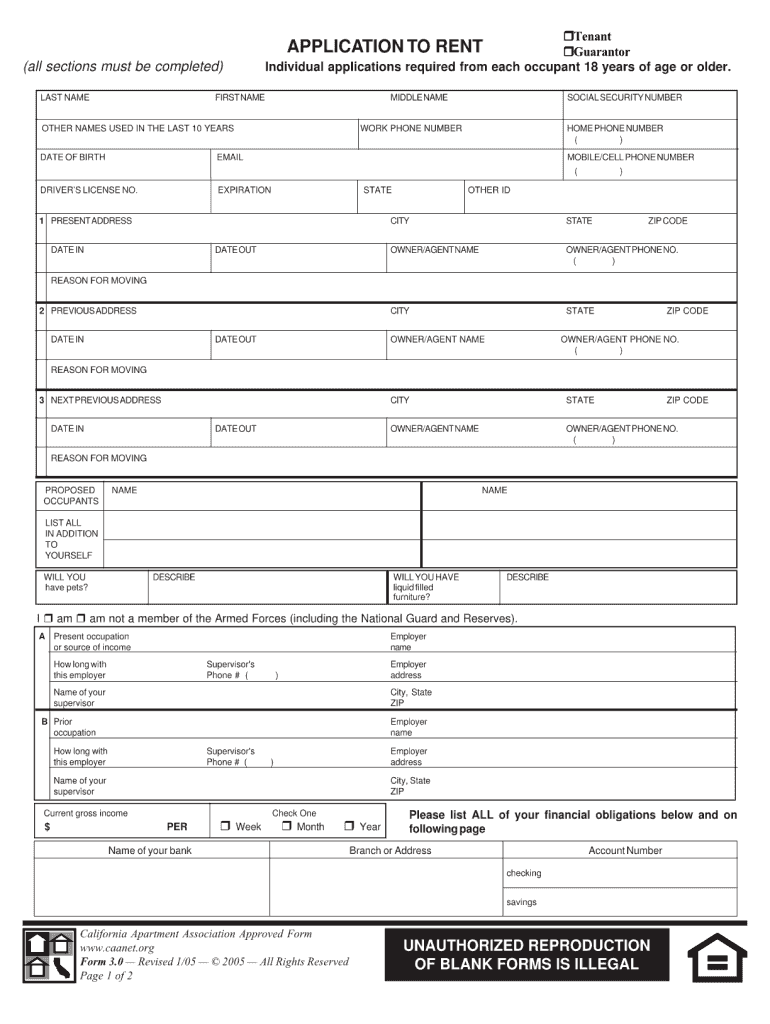

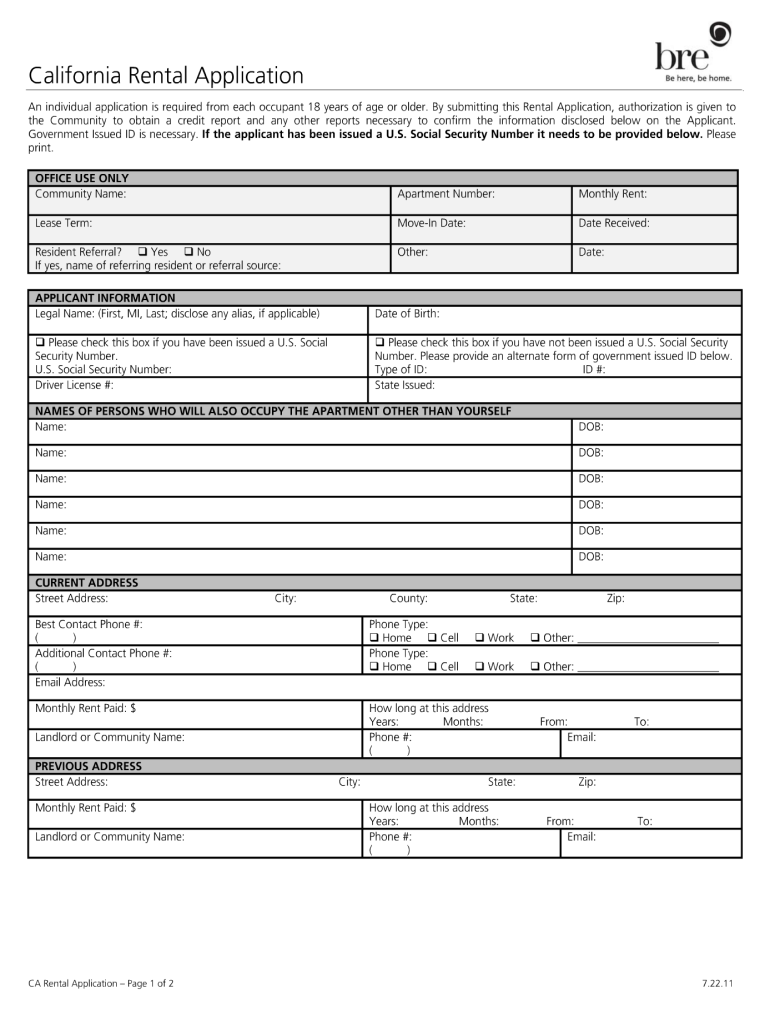

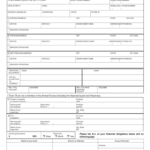

Rental Application Form California 2022 Pdf – Whenever you obtain a hire condo, it is important to fill in an in depth application, so the property owner can verify all information. As well as filling out the form, renters should also submit a credit history check and cover letter for the house owner. The following are the key steps from the software process: Rental Application Form California 2022 Pdf.

Renter track record verify

A renter history check out will help safeguard you from a potential danger by making sure the candidate is not just somebody planning to squat on the property but additionally someone that will be unable to spend rent payments promptly. A rental application consists of a number of crucial questions on the applicant, such as her or his income and work background. This information is vital to your evaluating process, in fact it is essential that you increase-examine the information the prospect gives.

Step one in carrying out a background review an prospect is to discover the applicant’s current deal with. This provides you with a sense of how long they’ve lived at this address and exactly how significantly they shell out in lease. You may also contact prior landlords to discover more on the applicant’s employment and income record. In addition, if the applicant has a criminal record, you can check the details of their criminal records.

Job cover letter

When filling in a hire application form, some candidates incorporate a job cover letter. If so, you’re increasing your chances of being selected. However, some portals do not require a cover letter, and some applicants may not want to include one at all. Adding a cover letter is a good idea, but some portals do not allow you to upload a cover letter, making it necessary to prepare your own.

When filling in a rental application form, make sure to publish your own personal info plainly and nicely. Point out any unique situations that you have, for example animals or allergies. Mention whether or not it is well behaved if you have a cat. You must also point out regardless of whether you do have a prior property owner or not. Ultimately, ensure your cover letter highlights your personality plus your interest in your property. This is a great way to show your property supervisor why they should rent your home.

Credit history check

In the state of New York City, property owners must have a credit score review a possible renter. The landlord need to deliver a notice conveying the credit rating in the applicant, together with their name, address, telephone number, and the reason behind the rejection. The landlord is additionally needed to provide an negative activity letter on the individual. In New York City, the utmost payment for processing an application is $20. The landlord should give the note in 2-3 enterprise days.

The property owner can create a rental application that requests for info such as the applicant’s banking account details, their personal references, as well as their credit score. It will also include their authorization to run a credit rating verify. Leasing program forms could be personalized to question these queries, and Jotform incorporates with more than 100 applications. If you have a credit check form for a new prospective tenant, you can download it from Jotform and customize it to fit your requirements.

Confirmation of income

When it comes to leasing apps, there are a few essential things you must check. Whilst focusing on a tenant’s earnings statement on their own form can be tough, it is vital to vet any paperwork they can provide. You might be shocked to discover that some renters may possibly provide deceptive files inside their leasing applications. The easiest method to prevent this problem would be to gather one or more other evidence of income. Fortunately, there are some straightforward techniques to verify earnings on the rental application form.

Financial institution records are an effective way to verify an applicant’s revenue. A property owner can demand a Pdf file backup of the tenant’s latest bank statement from a lender that shows itemized info. You are able to look for the applicant’s employer and name in the document. Look for the whole withdrawals and deposits over the past 2 months. Evaluate the total towards the applicant’s earnings. The applicant is more likely to qualify for a rental if they are in the same general range.