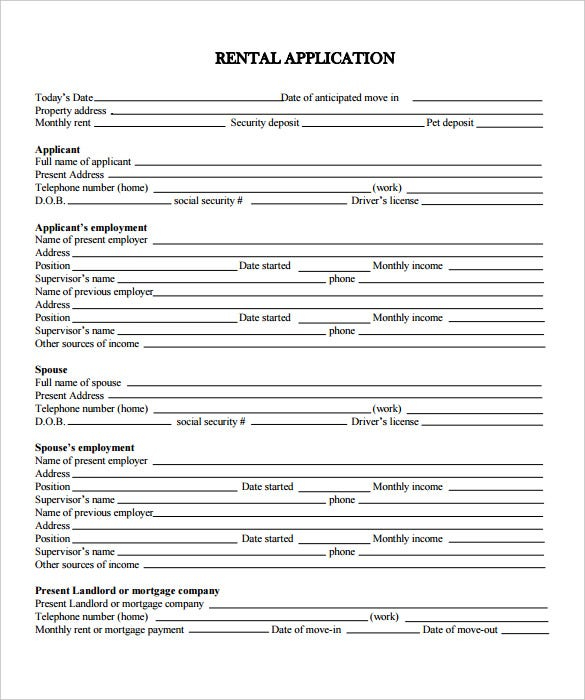

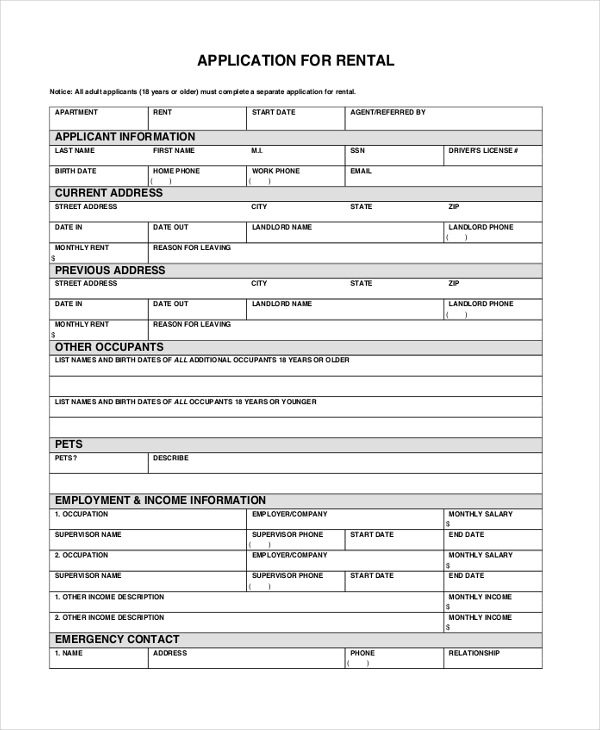

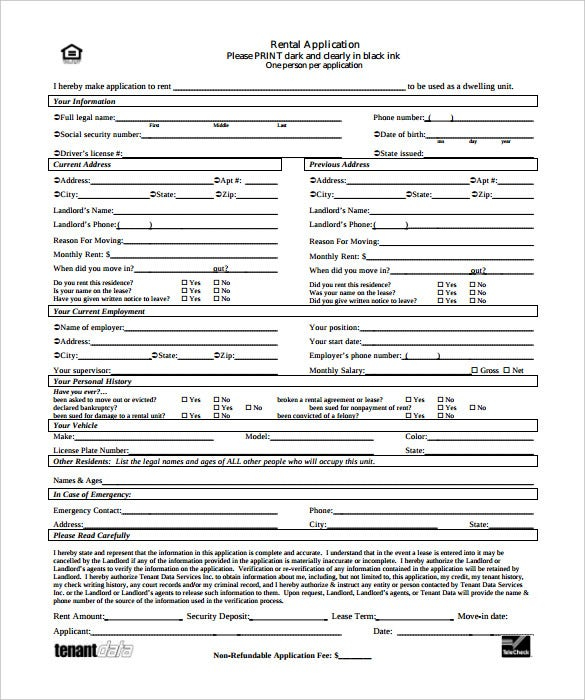

Generic Rental Application Form Pdf – Whenever you make application for a lease condo, it is important to fill out a comprehensive application, so that the landlord can authenticate all information. In addition to filling in the shape, renters should also distribute a credit history verify and resume cover letter to the property owner. Listed here are the real key steps in the software process: Generic Rental Application Form Pdf.

Renter background check out

A renter history check can help guard you against a potential risk by making certain the applicant is not just someone trying to squat on your residence but additionally someone who will not be able to pay out hire by the due date. A lease application contains a number of essential questions about the candidate, which includes his or her income and employment historical past. These details is important to your evaluating procedure, in fact it is essential that you increase-check the details the candidate gives.

The first step in performing a background review an prospect is to check the applicant’s current street address. This will provide you with an idea of just how long they’ve lived at that tackle and the way a lot they pay in rent payments. You can also make contact with past property owners to find out about the applicant’s income and employment history. If the applicant has a criminal record, you can check the details of their criminal records, in addition.

Resume cover letter

When filling in a hire form, some applicants incorporate a job cover letter. If so, you’re increasing your chances of being selected. Some portals do not require a cover letter, and some applicants may not want to include one at all. Adding a cover letter is a good idea, but some portals do not allow you to upload a cover letter, making it necessary to prepare your own.

When completing a rental application, be sure to create your own information and facts clearly and perfectly. Refer to any particular circumstances that you have, such as pets or allergic reactions. If you have a cat, mention whether or not it is well behaved. You need to point out regardless of whether you will have a earlier property owner or not. Finally, make certain your job cover letter shows your individuality plus your desire for your property. This can be the best way to display your property director why they ought to rent your house.

Credit rating check

In the state of Ny, landlords have to have a credit rating check up on a potential renter. The property owner must produce a notice explaining the credit rating in the prospect, in addition to their name, tackle, contact number, and the reason for the refusal. The landlord can also be required to provide an undesirable measures note to the prospect. In The Big Apple, the highest payment for digesting an application is $20. The landlord must deliver the notice inside two to three company time.

The landlord can create a hire software that openly asks for info such as the applicant’s banking accounts details, their personal references, along with their credit rating. It must include their consent to perform a credit score check. Lease app forms could be tailored to question these inquiries, and Jotform combines with over 100 software. If you have a credit check form for a new prospective tenant, you can download it from Jotform and customize it to fit your requirements.

Confirmation of revenue

In relation to lease applications, there are some important things you should check. Although taking note of a tenant’s earnings assertion on his or her application can be difficult, it is very important to veterinarian any paperwork they might supply. You might be amazed to find out that some renters could provide fraudulent paperwork within their lease applications. The best way to prevent this concern is to gather a minimum of one other evidence of revenue. Thankfully, there are many straightforward ways to confirm revenue on the leasing application form.

Bank assertions are an excellent way to verify an applicant’s earnings. A property owner can request a PDF version of the tenant’s latest banking institution document from a lender that reveals itemized information and facts. You may try to find the applicant’s name and employer in the assertion. Look for the total withdrawals and deposits over the past sixty days. Examine the entire on the applicant’s income. If they are in the same general range, then the applicant is more likely to qualify for a rental.