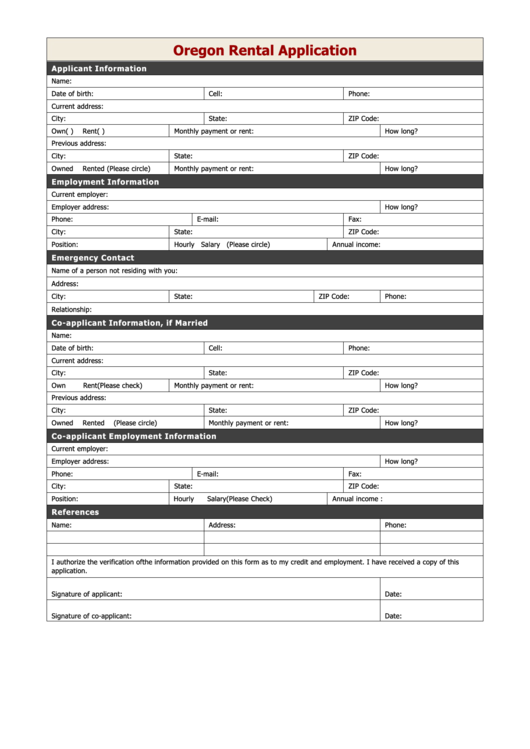

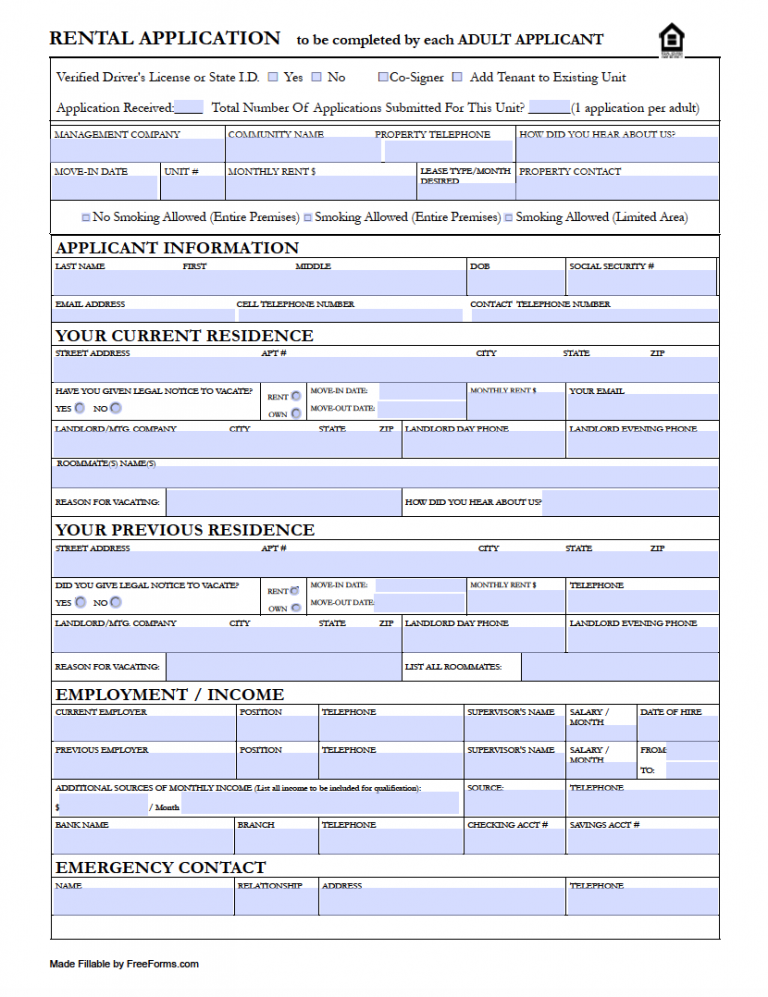

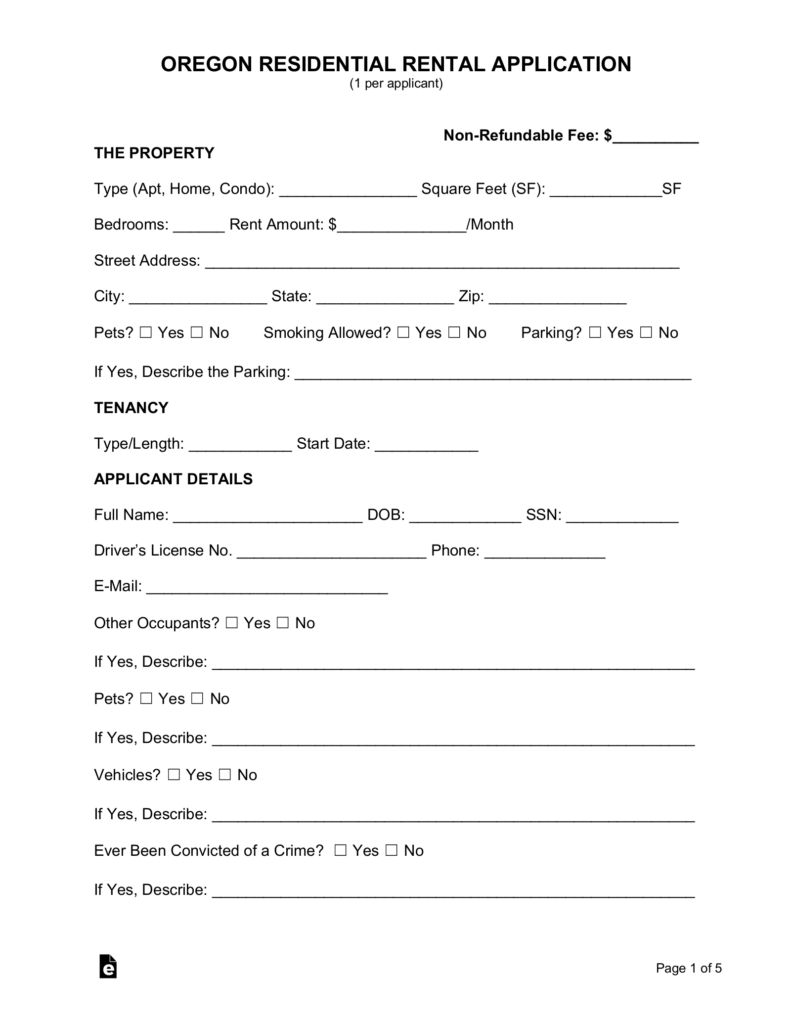

Oregon Rental Application Form Pdf – If you apply for a hire condo, it is essential to fill in a comprehensive form, in order that the property owner can verify all information. Along with submitting the shape, renters must also distribute a credit score check out and job cover letter towards the property owner. Allow me to share the important thing steps inside the program approach: Oregon Rental Application Form Pdf.

Renter background examine

A renter track record verify might help guard you a possible risk by guaranteeing the individual is not just somebody trying to squat on your residence but additionally somebody that will struggle to pay out lease punctually. A leasing software contains a number of important questions on the prospect, including his or her cash flow and work history. This data is critical in your verification procedure, which is necessary that you dual-examine the information the prospect supplies.

Step one in carrying out a track record review an individual is to discover the applicant’s current address. This will give you a solid idea of the length of time they’ve lived in that deal with and exactly how a lot they spend in hire. You may also speak to previous property owners to discover more about the applicant’s income and employment history. In addition, if the applicant has a criminal record, you can check the details of their criminal records.

Resume cover letter

When completing a leasing form, some individuals include a job cover letter. If so, you’re increasing your chances of being selected. Some portals do not require a cover letter, and some applicants may not want to include one at all. Some portals do not allow you to upload a cover letter, making it necessary to prepare your own, though adding a cover letter is a good idea.

When completing a hire application, be sure you publish your own details evidently and neatly. Talk about any specific scenarios that you may have, like household pets or allergic reactions. If you have a cat, mention whether or not it is well behaved. You need to mention no matter if you have a previous landlord or perhaps not. Eventually, be sure your resume cover letter features your individuality and your interest in the home. This is certainly a terrific way to present the home supervisor why they must lease your home.

Credit score verify

In the state of Ny, landlords are required to run a credit score check up on a potential tenant. The landlord should produce a message describing the credit score in the individual, together with their label, tackle, telephone number, and the reason behind the rejection. The landlord can also be needed to present an undesirable motion note to the applicant. In New York City, the highest fee for digesting a software is $20. The property owner must send out the note inside two or three business days.

The landlord can create a leasing program that openly asks for details such as the applicant’s banking account info, their personal references, along with their credit score. It must likewise incorporate their permission to run a credit score examine. Hire app kinds can be personalized to ask these questions, and Jotform integrates with more than 100 software. If you have a credit check form for a new prospective tenant, you can download it from Jotform and customize it to fit your requirements.

Confirmation of income

When it comes to rental apps, there are several important matters you should check. Whilst watching a tenant’s cash flow document on their application form can be challenging, it is very important to veterinarian any papers they could provide. You may be astonished to understand that some tenants may possibly present deceitful files inside their rental applications. The best way to steer clear of this issue is to accumulate a minumum of one other evidence of earnings. The good news is, there are many basic methods to validate earnings over a hire application.

Banking institution records are an effective way to confirm an applicant’s cash flow. A property owner can ask for a PDF version in the tenant’s newest bank statement coming from a lender that demonstrates itemized info. You can seek out the applicant’s name and employer about the declaration. Seek out the entire withdrawals and deposits within the last 2 months. Compare the whole to the applicant’s earnings. The applicant is more likely to qualify for a rental if they are in the same general range.